Forex trading is a risky activity that involves buying and selling currencies. Currencies rise and fall in value based on political or economic factors. Forex trading occurs 24 hours a day, 5 days a week.

The Forex market offers high returns and fast-paced action, but it also carries risks – especially when using leverage. If you are not able to tolerate losses, then forex trading is not for you.

High Profits

Forex is the world’s largest financial market. It’s open 24 hours, five days a week around the world. Investors can take advantage of the high profits that come with this type of trading. This is especially true if they are able to employ a strategy that works consistently.

The basic concept behind forex trading is that investors can make money by speculating on the future direction of currencies. This is done by buying one currency while simultaneously selling another. The value of a currency pair is determined by the strength and stability of the respective economies that they represent. This makes forex trading an attractive option for those who are looking for a steady source of income.

However, it’s important to remember that no trading system can guarantee profit over the long term. According to market research, only about 33% of all traders are able to profit from trading on a consistent basis. Therefore, those who are interested in trading should consider carefully how much capital they are willing to put at risk. It’s also important to understand that there is no such thing as a guaranteed win in forex trading. It is only possible to earn decent payouts if you are able to accurately predict the direction of the markets, which can be challenging at times.

As with any trading platform, there is a learning curve associated with forex trading. It’s important to start small and gradually increase your stake size as you gain experience. This will allow you to avoid losing too much of your trading capital and can help you to develop a profitable and sustainable trading strategy.

Another benefit of forex trading is the ability to use leverage. This allows you to trade a larger position than you would with just your own money. However, it’s important to remember that using leverage comes with a higher level of risk and can lead to large losses as well as big wins. Therefore, it’s important to always use a stop loss and take profit target to limit your risk.

Fast-Paced Action

The global forex market is open 24 hours a day and offers traders multiple trading opportunities. The markets don’t operate as a traditional exchange, like Wall Street, instead operating through a complex network of brokers and computers all over the world. There are three types of forex markets that traders can trade – spot, forward and futures.

The spot market is the main forex market where currency pairs are traded. It is an over-the-counter (OTC) market that allows two private parties to agree to swap currencies at a current price. The price is determined by supply and demand. It is the largest and most liquid market in the world, with many participants and daily price volatility.

There are two major categories of traders in the forex market – institutions and retail traders. Institutions, such as large banks, manage large sums of money and are responsible for most of the spot market volume. They trade for a variety of reasons, including hedging international currency risk and speculating on geopolitical events. Retail traders, on the other hand, trade for their own account and are primarily concerned with making profits from speculative trades.

Forex trading is conducted in pairs, with one currency being purchased while the other is sold simultaneously. There are eight major currency pairs, which include the USD, EUR, GBP and AUD. There are also several minor pairs and exotic pairs. The majority of trades are made in the major currency pairs.

Traders can enter the market by opening an account with an approved forex broker, then depositing funds to begin trading. They then use various analysis tools and strategies to predict market movements and make trades accordingly. Two of the most popular analysis tools are fundamental and technical analysis. A trader’s skill in using these tools will determine the success of their trades.

Once a trader has mastered basic analysis, they can begin to experiment with trading styles. Day trading is one popular style that involves entering and exiting positions within a single day. This type of trading is a great way to gain experience in the market while also generating consistent profits.

Opportunities for Learning and Growth

Forex trading is a highly complex process that requires a significant amount of learning, practice and dedication to master. However, like any other profession or skill, it can be learned with persistence and hard work. Once mastered, the potential for high profits can be a great reward for all your efforts.

The forex market is a global marketplace for buying and selling currencies. The prices of currencies are determined by the market, which is a mix of retail traders and large financial institutions. There is no central exchange in the forex market, and trading occurs over the counter (OTC) through a network of brokers.

The currency markets are open 24 hours a day, five days a week. The fast-paced action can be exciting and engaging for new traders, especially when paired with a solid risk management strategy. However, it is important to remember that forex trading is a highly risky investment and trades are done on leverage, which can magnify your losses as well as your gains.

Unlike the stock market, which is centralized and traded on an exchange, forex trading takes place over the counter. This makes it more accessible to traders with smaller budgets than those who are interested in a diversified portfolio of stocks and bonds. In addition, the forex market is highly liquid, meaning there is always a buyer or seller for a particular currency pair.

For those with longer-term horizons and more funds, forex can be a great way to generate consistent income by making profitable carry trades or capitalizing on macroeconomic fundamentals. Those who are interested in shorter-term strategies can also find success in the forex market by using tools such as technical analysis and scalping.

There are also career opportunities in the forex industry, from traditional traders to marketing and software development positions. In addition, the ability to learn from one’s own experiences and from other traders is a valuable skill that can be applied to any professional endeavor. However, it is important to recognize that each person’s approach to trading is unique and should be respected accordingly.

Social Activity

Forex trading is a global market for the buying and selling of currencies. It’s how individuals, businesses, central banks and governments pay for goods and services in different countries. For example, when you buy a pair of shoes online from an international retailer, you’re using the foreign exchange market to make the payment. Forex trading is also a popular form of speculative investing, where traders try to profit from changes in currency prices.

There are two main types of traders in the forex market – institutions and retail traders. Institutions, like banks and fund managers, trade forex on behalf of their clients. This type of forex trading makes up the majority of the market’s volume. Speculators, on the other hand, trade for their own accounts. They can be large speculators, like hedge funds, or small speculators, such as individual retail traders.

Currencies are traded on the foreign exchange market, a global marketplace that’s open 24 hours a day, except for U.S. holidays. This market is overseen by a global network of banks and financial institutions. Unlike the stock market, where securities are traded on a central exchange, forex trading takes place over-the-counter (OTC).

The key to successful forex trading is anticipating how one currency will perform against another. Traders can use this information to make profitable trades. Currencies rise and fall in value based on factors like geopolitical events, economic data and natural disasters. Traders who predict that a currency will rise in value can buy it and sell another currency at the same time to make a profit.

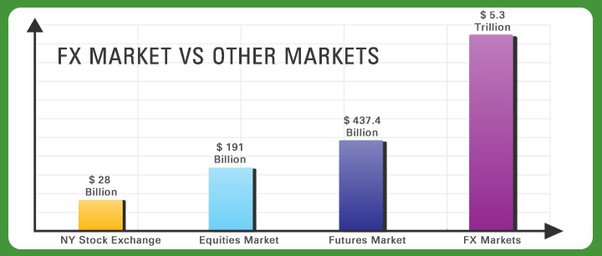

A fun fact about forex trading is that it dates back to ancient times. The first currency transaction was recorded in Talmudic writings, where money changers helped people change their currency for a fee. In the modern world, forex trading is incredibly popular. It’s the largest market in the world, with trading occurring over $5 trillion a day.

While forex trading can be a serious business, it’s also an exciting and lucrative opportunity for those who are willing to put in the work. By taking advantage of the unique jargon and market quirks, you can have a blast while making money.